Unique Logistics International, Inc.

154-09 146th Ave.

Jamaica, NY 11434

February 23, 2024

Jennifer O’Brien

U.S. Securities & Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re: Unique Logistics International, Inc.

Form 10-K for Fiscal Year Ended May 31, 2023

Amendment No. 1 to Form 8-K filed May 5, 2023

Response dated January 22, 2024

File No. 000-50612

Dear Ms. O’Brien:

By letter dated February 1, 2024, the staff (the “Staff” or “your”) of the U.S. Securities and Exchange Commission (the “Commission”) provided Unique Logistics International, Inc. (the “Company” or “we” ) with its additional comments to the Company’s Form 10-K fiscal year ended May 31, 2023 and response dated January 22, 2024. We are in receipt of your letter and set forth below are the Company’s responses to the Staff’s comments. For your convenience, the comments are listed below, followed by the Company’s responses.

Financial Statements

Notes to Consolidated Financial Statements

2. Acquisitions and Equity Method Investments, page F-16

| 1. | We note from your response to prior comment 2 that “ULHK is an entirely separate legal entity with an unrelated ownership structure.” However, it remains unclear to us whether certain shareholders hold significant equity interest in both Unique Logistics International, Inc. (“the Registrant”) and the ULHK entities that were acquired. Please provide us with a comprehensive analysis of common ownership interests in the Registrant and the ULHK entities held by significant shareholders, demonstrating, and supporting your conclusion that the acquisition of the ULHK entities are not transactions between entities under common control. In this regard, please provide us with a tabular presentation depicting the ownership structure and related ownership percentages of significant shareholders in the Registrant and each ULHK entity acquired on February 21, 2023, as identified on page F- 16. The table should include the requested ownership percentages of significant shareholders before and after the “ULHK Entities Acquisition.” |

Response:

The table below depicts common ownership interests in the Company held by significant shareholders before and after ULHK Entities Acquisition. There was no change.

| Ownership of UNQL (Registrant/Buyer) | Before acquisition | After acquisition | ||||||

| Sunandan Ray (CEO) | 48.5 | % | 48.5 | % | ||||

| Unique Logistics Holdings Ltd. (ULHK/Seller) | 10.4 | % | 10.4 | % | ||||

| Todd Sherman | 5.0 | % | 5.0 | % | ||||

| Southridge | 12.5 | % | 12.5 | % | ||||

| 3A Capital Establishment | 12.5 | % | 12.5 | % | ||||

Company management completed an analysis, as set forth below, and, as a result of such analysis, concluded that the Company and ULHK are not entities under common control for the purposes of application guidance of ASC 805-50 Business Combinations:

| ● | The Company and ULHK are separate legal entities with independent management and unrelated ownership structures, except for ULHK’s 10.4% noncontrolling ownership interest in the Company. | |

| ● | After the ULHK Entities Acquisition, there was a complete change of control of the ULHK Entities with the Company assuming full management of the acquired entities (other than entities accounted for as equity method investments) and the only relationship between the Company and ULHK is ULHK’s approximate 10.4% interest (on a fully diluted basis) in the Company in the form of 153,062 shares of the Company’s Series B Convertible Preferred stock, which are convertible into shares of the Company’s common stock at a rate of 6,546.47 shares of common stock for every one share of Series B Convertible Preferred stock. | |

| ● | Even though ULHK continues to hold this preferred stock, like all other holders of Company preferred stock it votes on as-converted basis with the common stockholders, voting together as a single class. While beneficial ownership of 10% or more of an entity’s voting stock is a fact to be considered when determining control status, it is not necessarily determinative. American Standard, SEC No-Action Letter, 1972 SEC No Act. LEXIS 3787 at *1 (Oct. 11, 1972). In this regard, Management applied guidance of ASC 810-10-15-8, where the term “control” has the same meaning as the term “controlling financial interest.” For legal entities other than limited partnerships, the usual condition for a controlling financial interest is ownership of a majority voting interest; therefore, as a rule ownership by one reporting entity, directly or indirectly, of more than 50% of the outstanding voting shares of another entity is a condition pointing toward consolidation. Control may also be established in other ways, such as variable interests, but none of the consolidated ULHK Entities were deemed to be a variable interest entity based on guidance of ASC 810. Three Company shareholders beneficially own a greater percentage of the Company’s common stock, on a fully diluted basis, than does ULHK, including the Company’s Chief Executive Officer, who owns 48.5% of the common stock on a fully diluted basis; the Company’s officers and directors together hold more than 50% of the common stock on a fully diluted basis and, as a result, have full control of Company decisions, including those that require a shareholder vote. |

Accordingly, management concluded that ULHK’s preferred stock ownership did not constitute control of the Company and, therefore, that its acquisition from ULHK of its interest in the ULHK Entities was not a transaction with a related party under common control and is properly treated as a business combination under guidance set forth in ASC 805, which requires that identifiable assets acquired, liabilities assumed and any noncontrolling interest in the acquiree be recognized and measured as of the acquisition date at fair value.

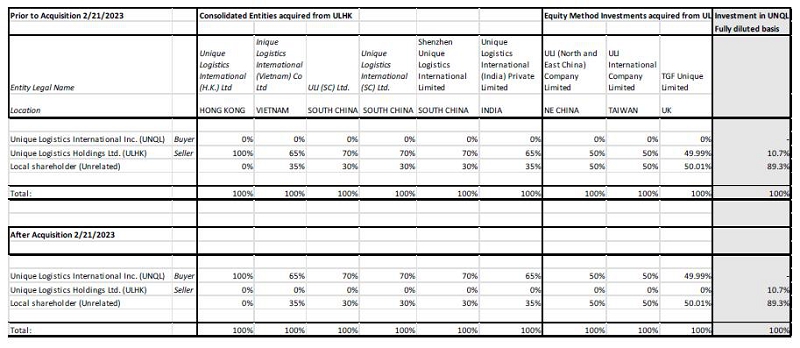

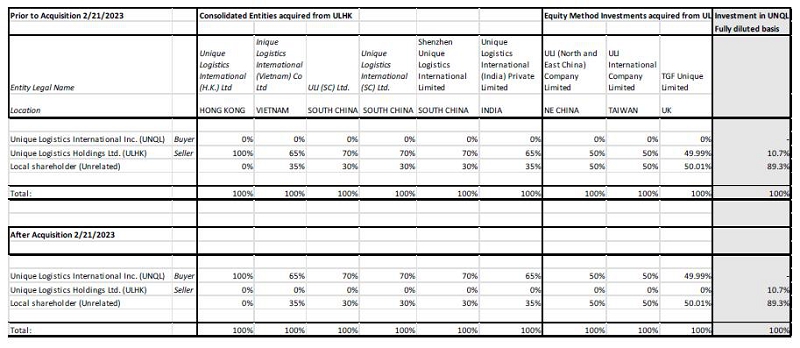

The ownership of the ULHK Entities before and after the ULHK Entities Acquisition is depicted in the table below. The information in the table below shows that full transfer of ownership of ULHK’s interests in the ULHK Entities from ULHK to the Company occurred at the time of the ULHK Entities Acquisition (other than with respect to Unique-Taiwan and Unique-Vietnam, the completion of which was subject to receipt of applicable regulatory approvals, as we have previously discussed), such that ULHK retained no interest in these entities.

Amendment No. 1 to Form 8-K Filed on May 5, 2023

Item 9.01. Financial Statements and Exhibits

| 2. | We have considered your response to prior comment 6. We defer our evaluation of your response relating to compliant audit reports and required financial statements of the ULHK entities until you can address those items in their entirety. Regarding your response included in the second bullet point, we note that reconciliations to U.S. GAAP appear required for the following entities: Shenzhen Unique Logistics International Limited, TGF Unique Limited and Unique Logistics International Co., Ltd (Taiwan). Please review the following exhibits: 99.5, 99.14, 99.7, 99.16, 99.25, 99.15, and clarify for us why reconciliations to U.S. GAAP are not provided, or provide the reconciliations as warranted. |

Response:

We acknowledge the Staff’s comment with respect to the portion of prior comment 6 regarding filing revised audit reports and financial statements of the ULHK Entities that have been audited in accordance with US GAAS or PCAOB standards.

As to the second bullet point of our prior response, we acknowledge that reconciliations to U.S. GAAP or IFRS for the above-cited ULHK Entities were inadvertently omitted from the Company’s Form 8-K/A filed with the Commission on May 5, 2023. The Company will file a second amendment to the original Form 8-K, which will include amended versions of the above-referenced exhibits that include the required reconciliations, at a later date.

Finally, it is our understanding that this comment relates to the requirements with respect to the Company’s Form 8-K to report the ULHK Entities Acquisition, and that no such information would be required in the Company’s annual reports on Form 10-K once the financial information of the acquired ULHK Entities are included in the Company’s audited consolidated financial statements for at least nine months.

Thank you for your assistance in reviewing this filing.

| Very truly yours, | |

| Eli Kay | |

| Chief Financial Officer | |

| Unique Logistics International, Inc. |